how to calculate pre tax benefits

Often the type of deduction you need to make is predefined in the policy for the benefit. 20000 250000 008.

Find Variances Small Business Tax Deductions Small Business Tax Business Tax Deductions

Subtract the value of your debt service from your NOI.

. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied. There are many different types of pre-tax benefits but for the.

50000 30000 20000. Your pre-tax cash flow benefits therefore add up to 16800. Pre-EMI is only the interest paid during the period.

After deducting the health insurance premiums the employees pay is 1700. When you enrolled in the plan your employer should have given you the amount which would be deducted from your paychecks. The employer portion of the FICA tax is lower too with pre-tax deductions.

The pretax earnings is calculated by subtracting the operating and interest costs from the gross profit that is. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit. Note that other pre-tax benefits could lower your taxable income further After-tax contributions are those you make from your net pay that is your income after taxes.

This reduces the amount of taxable wages that an employee has to pay taxes on. 17000 X 765 13005. Ryan Menezes is a.

Leaving your pre-tax profit margin at 8. Therefore you pay 5040 biweekly in Social Security tax. Significance of Pretax Income.

There are other formulas to calculate Earnings before tax from the Income statement under. Once enrolled you have the monthly cost of your commute deducted from your pay before paying taxes. Provides insight into a companys financial standing.

Thus Sackett Laboratories made an Earnings Before Tax of 6200 during the year. Based on the above information we can do the calculation of Pretax income using the formula discussed above Pretax Income formula Net Sales- Cost of goods sold-Operating Expenses. But the nuances of pre-tax and post-tax benefits can be complicated so its essential to understand how they work before you offer them to your employees.

The amount of the savings will vary based on the contribution towards the benefit. Withhold 765 of adjusted gross pay for Medicare tax and Social Security tax up to the wage limit. The pre-tax income line item often used interchangeably with earnings before taxes EBT represents a companys taxable income.

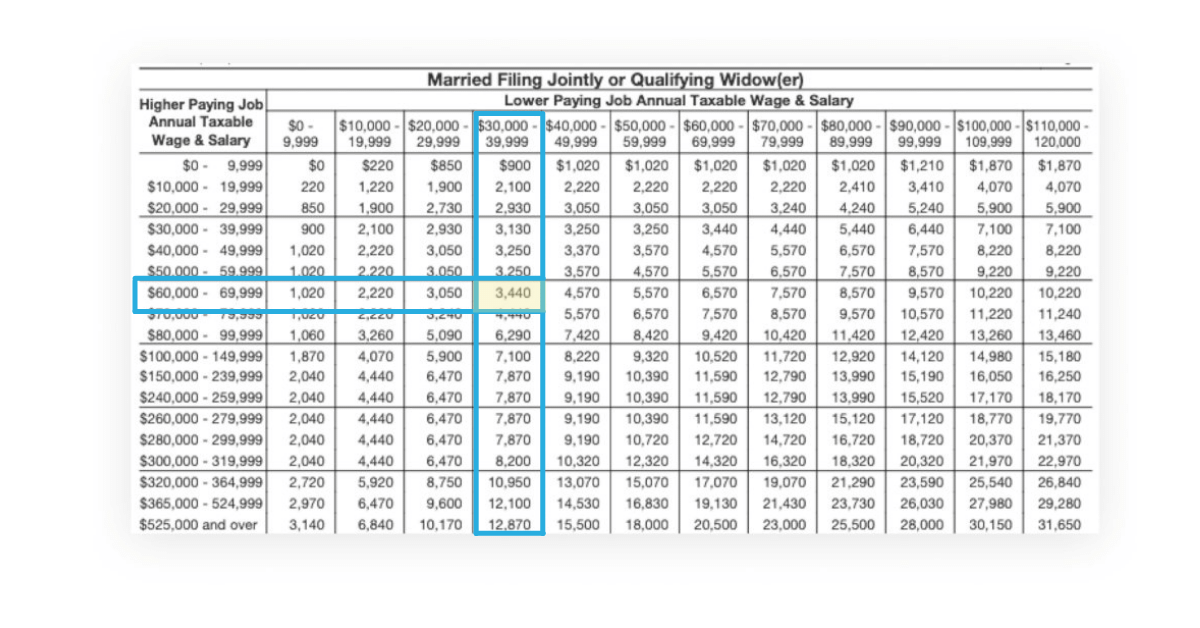

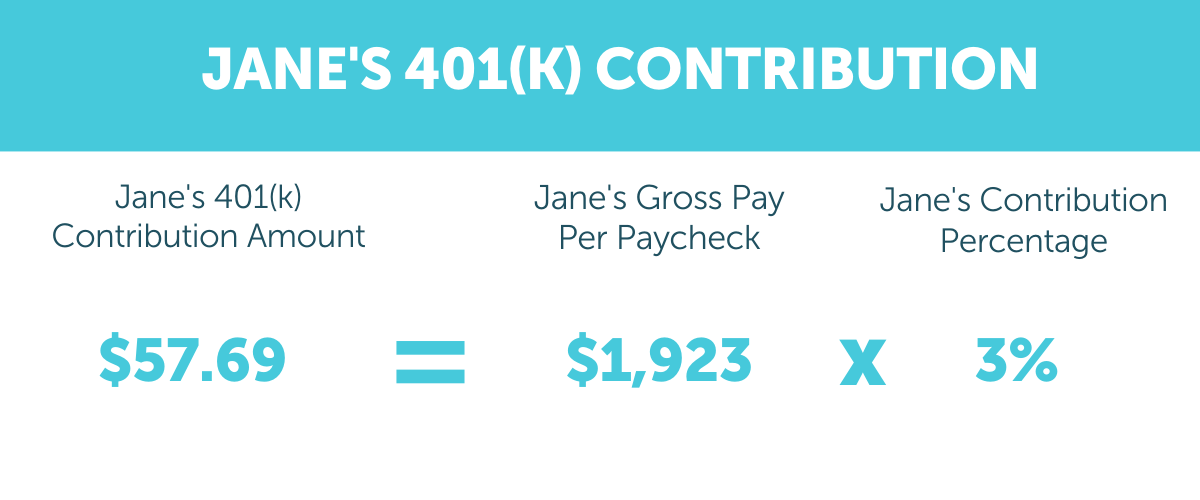

Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits. If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax. Some benefits can be either pre-tax or post-tax such as a pre-tax vs.

You then divide your pre-tax earnings and gross income. How to calculate pre-tax health insurance. On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments.

Finance costs include the interest paid by the business on the loans taken from the bank. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be depicted as tax deduction for the next 5 years. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

Maximize Your Tax Refund. 2000 300 1700. Meanwhile your employer saves up to 765 percent on payroll tax.

How to Calculate Pre-Tax Income. In this final step deduct the entire expense total from the revenue total to get the pre-tax Income figure. CPA Professional Review.

Taxes affect the overall earnings of a company. This permalink creates a unique url for this online calculator with your saved information. For example you earn 1200 biweekly.

A pretax health insurance plan generally includes medical dental and vision coverage for you your spouse and your dependents. When an employee pays for benefits such as health insurance with before-tax payments the deduction is taken off their gross income before taxes. How much can pre-tax contributions reduce your taxes.

Check your pay stubs as they might show the individual deductions for all your insurances. 23000 is 6200 more than 16800. Calculate the employees gross wages.

Your employer may cover some of the cost. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax. Commuter benefits are pre-tax.

As a result this lowers the total income amount that is taxed which reduces the income taxes the. Ad Prevent Tax Liens From Being Imposed On You. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes.

Sometimes you or the employee might have the option to choose whether or not a benefit has pre-tax vs. Her gross pay for the period is 2000 48000 annual salary. How do I calculate pre-tax.

Following are the expenses of the company during the year. 2000 X 765 153. Figure your insurance amount for each pay period.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Discover Helpful Information And Resources On Taxes From AARP. Pretax earnings hence provide an insight into the companys financial performance and standing before its tax expense affects the net earnings and brings about any fluctuations.

By the time you reach the pre-tax line item the starting line item of the income statement ie the companys revenue in the period has been adjusted for. Generally speaking pre-tax deductions provide an immediate tax break while post-tax deductions give employees a bigger paycheck. With pre-tax benefits you withdraw the amount to cover the cost from an employees paycheck before its taxed.

But a Section 125 plan is pre-tax. For example it may cover. Please note that any principal amount is not eligible.

Divide Saras annual salary by the number of times shes paid during the year. This is your annual net operating income NOI. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

In this article well define pre-tax and post-tax.

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

A Visual Guide To Employee Ownership

What Is Income Tax Income Tax Return Income Tax Tax Refund

Starting The Loan Application Is The First Step To Finding Your First Home To Decide If You Qualify Mortgag Mortgage Sell My House Fast Mortgage Loan Officer

Pre Tax Vs After Tax Medical Premiums

Request Our Guide To Understanding Your Insurance Co Insurance Health Information Management Medical Social Work

E File Your Income Tax Returns In 5 Minutes On Cleartax Just Upload Your Form 16 And Cleartax Will Automatically Pre Tax Refund Filing Taxes Income Tax Return

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Network Marketing Tax Benefits Google Search Direct Sales Business Business Tax Tax Deductions

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Dave Ramsey Investing Investing

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Are Payroll Deductions For Health Insurance Pre Tax Details More

Best 5 Payroll Software System For Businesses Reviano Bookkeeping Business Payroll Software Payroll